CBOE Holdings, China Central Depository & Clearing Corporation and Tokyo Stock Exchange to join global index industry association

New York, May 9, 2017 – Index Industry Association (IIA), a global organization of index administrators, has today announced the addition of three new members. CBOE Holdings (CBOE), China Central Depository & Clearing Co., Ltd. (CCDC) and the Tokyo Stock Exchange, Inc. (TSE) will join IIA in promoting awareness of the function of indices in global markets.

Since its launch in 2012, IIA has offered the index industry a way to advocate for independence and transparency in indices in order to serve the needs and interests of investors. The indices created by CBOE, CCDC and TSE align with the IIA mission for indices to operate as the best measures of the markets, apart from any specific outcome. CCDC and TSE represent the organization’s expansion of Asian-based members, and speak to the growing global interest in promoting best practices in the index industry.

“The addition of CBOE, CCDC and TSE emphasizes the advantages that members of the Index Industry Association feel that investors will realize from educating the global investor community about the importance of proper index design, administration, maintenance, and calculation,” said Richard Redding, chief executive officer of IIA. “We look forward to working together to promote standards across the industry as the importance of independent indices continues to grow.”

CBOE is the creator of index options and the leading developer of volatility indices that measure market volatility. It also creates strategy performance indices to help investors track the performance of investment strategies that use options or volatility products to help manage risk and enhance yield. The CBOE Volatility Index (VIX) Index is the centerpiece of CBOE’s volatility franchise which includes more than three-dozen volatility-related benchmarks. CBOE currently publishes data on more than 30 strategy performance benchmark indices. CBOE’s Bats Europe exchange offers 39 benchmark indices across 15 major European markets.

CCDC is a central securities depository (CSD) approved by the State Council of China and is the only government bond depository authorized by the Ministry of Finance. ChinaBond Index, as part of ChinaBond Pricing Data Products, is published by CCDC, drawing on its neutrality and expertise as a CSD. Since 2002, the ChinaBond family of indices has been a reference for the onshore Renminbi (RMB) bond market. CCDC now publishes more than 70 indices – and hundreds of sub-indices – on a daily basis, covering more than 30,000 constituents of the China domestic bond markets.

TSE, as a cash exchange operating subsidiary of Japan Exchange Group, Inc. provides a variety of index products that gauge the performance of the Japanese equities market, and are employed by investors and financial services firms worldwide. The exchange offers more than 300 indices, with composition determined by metrics including style, size, risk and sector.

IIA was founded as the first-ever trade association for the index industry, and is continuing its expansion to serve the global investor community. Created as a not-for-profit organization for the fast-growing community of index providers, the IIA membership is open to independent index administrators worldwide.

###

For more information about the IIA or to speak with Richard Redding, please contact Intermarket Communications at IIA@intermarket.com or 212.754.5181.

About Index Industry Association (IIA):

IIA is an independent, not-for-profit organization based in New York that represents the global index industry. Founded in March 2012, the association is the first ever index industry trade body and it is committed to representing the global index industry by working with market participants, regulators, and other representative bodies to promote sound practices in the index industry that strengthen markets and serve the needs of investors. Our members have calculated indices since 1896 and, in the aggregate, the members of IIA calculate approximately two million indices for their clients, covering a number of different asset classes, including equities, fixed income, and commodities.

Many of the leading index providers in the world are members of IIA, including Bloomberg Barclays, Chicago Booth Center for Research in Security Prices, FTSE Russell, ICE Data Services, IHSMarkit, Morningstar, MSCI Inc., Nasdaq Global Indices, S&P/Dow Jones Indices, SGX and STOXX.

CBOE Holdings, (BATS: CBOE | NASDAQ: CBOE), owner of the Chicago Board Options Exchange, the Bats exchanges, CBOE Futures Exchange (CFE) and other subsidiaries, is one of the world’s largest exchange holding companies and a leader in providing global investors cutting-edge trading and investment solutions. The company offers trading across a diverse range of products in multiple asset classes and geographies, including options, futures, U.S. and European equities, exchange-traded funds (ETFs), and multi-asset volatility and global foreign exchange (FX) products. CBOE Holdings’ 14 trading venues include the largest options exchange in the U.S. and the largest stock exchange in Europe, and the company is the second-largest stock exchange operator in the U.S. and a leading market globally for ETF trading. For more information, visit www.cboe.com.

About China Central Depository & Clearing Co., Ltd.:

China Central Depository & Clearing Co., Ltd. (CCDC) is the sole Central Securities Depository (CSD) established with the approval of the State Council of China. The institution, as a core financial market infrastructure, supports the daily operation of China Interbank Bond Market (CIBM) and functions as a core platform for CIBM opening up. CCDC now has over RMB 95 trillion of all types of financial assets under its depository, among which over RMB 44 trillion are bond assets (including the vast majority of sovereign, quasi-sovereign and other high-grade bonds in China), and has settled transactions of more than RMB 1,000 trillion over 2016. So far, more than 470 overseas investors have entered CIBM and opened accounts with CCDC, holding around RMB 800 billion of bond assets, accounting for 90% of the total bond holdings by overseas investors in CIBM. For more information, visit http://www.chinabond.cn/d2s/eindex.html.

About Tokyo Stock Exchange, Inc. (TSE):

Tokyo Stock Exchange, Inc. (TSE) is a licensed financial instruments exchange under the Financial Instruments and Exchange Act of Japan, which is engaged in the provision of market facilities for trading of securities, publication of stock prices and quotations, ensuring fair trading of securities and other financial instruments, and other matters related to the operation of exchange financial instruments markets. TSE developed and started calculation of “TSE Stock Average” in September 1950. Later in July 1969, TSE developed and began calculation and publication of TOPIX (Tokyo Stock Price Index). Since then TSE has developed, and calculates and publishes a wide variety of indices. For the complete list of TSE’s indices, please refer to the following website. For more information, visit www.jpx.co.jp/.

You might also be interested in

Index Industry Launches Continuing Education Program with CFP Board Approved Course

Washington, D.C. – July 9, 2025 – The Index Industry Association (IIA), serving as the global voice…

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

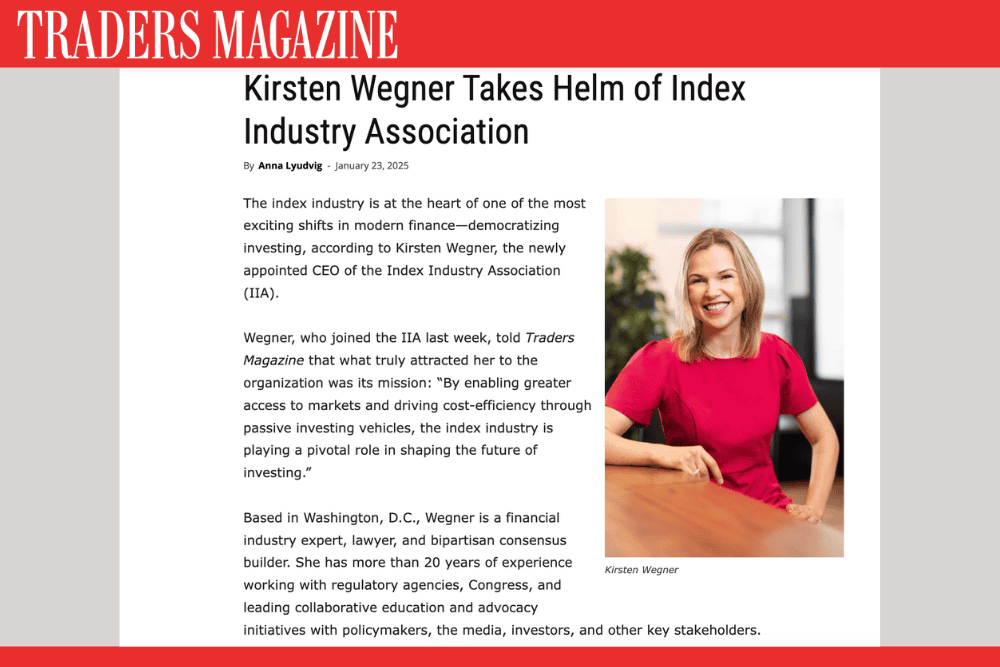

Traders Magazine

Kirsten Wegner Takes Helm of Index Industry Association

Traders Magazine