Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council had approved the text on 12 March. The provisions will start to apply on 1 January 2026.

On the record statement from IIA CEO Kirsten Wegner:

The final approval of the Benchmark Regulation in the European Parliament marks an important step in maintaining trust and oversight while allowing Europe’s index ecosystem to remain agile and competitive.

The IIA strongly supports the retention of the EUR 50 billion threshold for significant benchmarks, which ensures a proportionate, risk-based approach. Affordable and widely accessible index data plays a vital role in transparent, efficient markets and regulation should preserve that. We also welcome the resolution of the long-standing third-country regime issue which reflects a more practical, targeted framework.

As the third-country regime and ESMA’s expanded supervisory role take shape, it’s essential these changes avoid unnecessary complexity, costs, or the risk of dual supervision. We look forward to continued collaboration with supervisors and stakeholders to ensure smooth implementation.

You might also be interested in

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

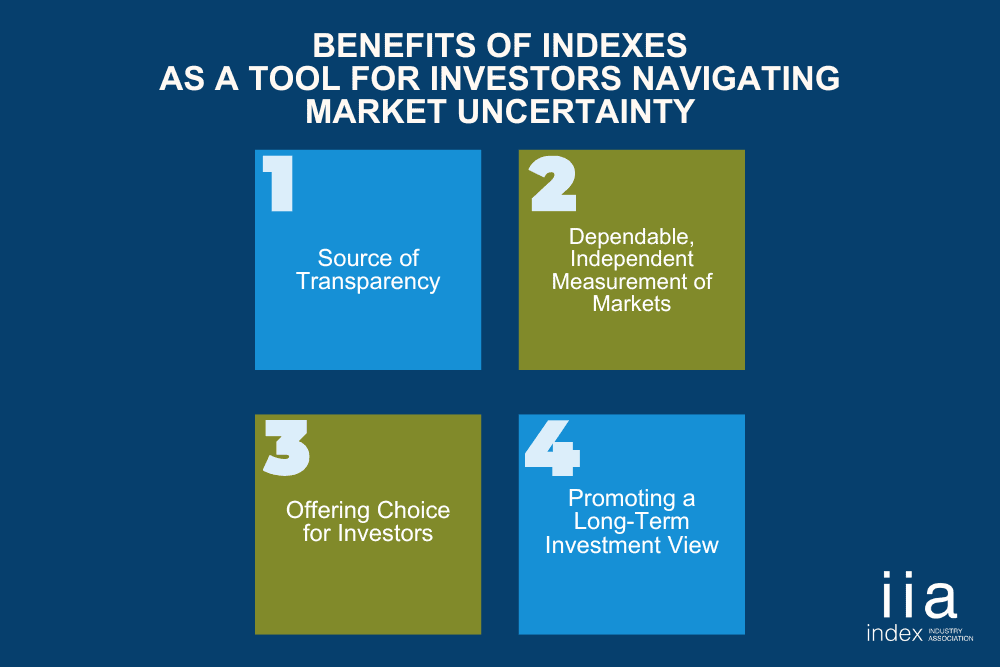

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…