Entering 2024, change was afoot in the asset management industry driven by an anticipated volatile economic environment, an election super cycle, political polarization around ESG investing and unbridled hype around AI. At the mid-point of the year, a clearer picture began to emerge of how managers are navigating 2024 and what it portends for 2025 and beyond.

The report explores:

- The impact of generative AI and related technologies

- Changing views on ESG factors in investing

- The growth of new markets and asset types

IIA 2024 Survey Snapshot

Please see below for a quick snapshot of stats around our 4th annual survey of global asset managers

0%

Proportion of managers noting generative AI is the topic raised most frequently

0%

Proportion of managers that say client demand is the top factor driving their ESG policy/strategy

0%

Proportion of asset managers that view private markets as an opportunity vs 29% as a challenge

0%

Proportion of managers noting index providers will become more important to their firm's success

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

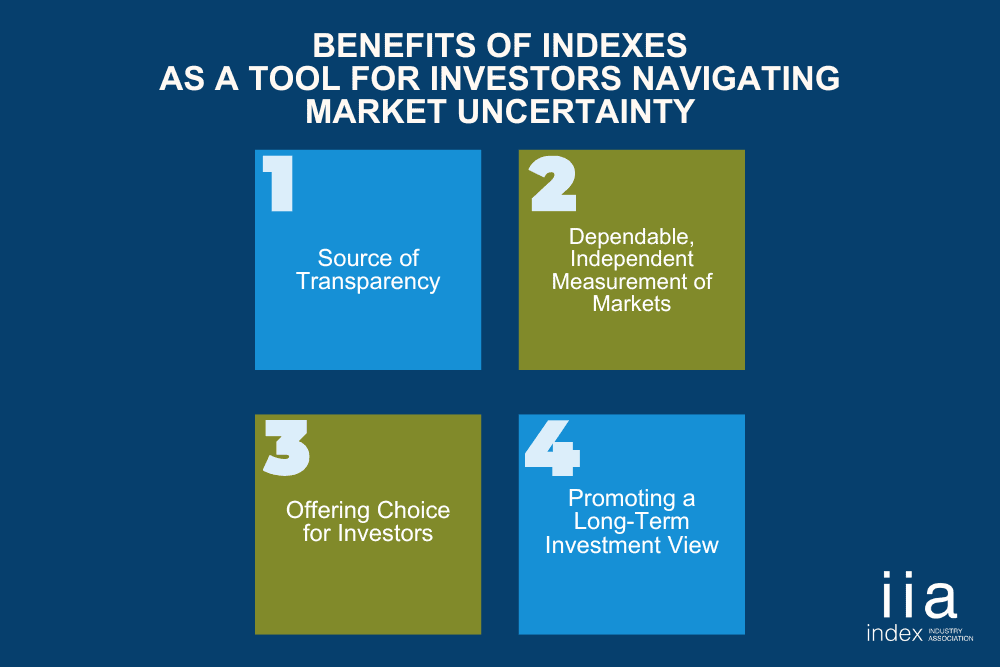

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…