The IIA released our Second Annual Global ESG Survey of Asset Managers. This year’s survey examined the evolving role of ESG investment in the asset management industry and the growth it experienced in the face of geopolitical instability, a 40 year high in inflation and six months of market volatility.

We once again, partnered with Opinium for this survey, who helped capture the views of 300 Chief Investment Officers, Chief Financial Officers, and portfolio managers across the U.S., UK, France, and Germany.

The data found that, across regions, despite this backdrop of volatility, there was increasing momentum and increasing interest in ESG investment across all asset classes. On top of that, as the incorporation of ESG elements has expanded across asset manager’s portfolios, the survey found significant improvement in the tools, metrics and services used for environmental impact, social sustainability, and corporate governance tracking from last year’s survey.

Here are some of the highlights from the report:

Importance of ESG and Growth Projections

The vast majority (85%) of respondents reported that over the past year, ESG has become more of a priority within their company’s overall investment offering or strategy, with just over a quarter (26%) saying it is “much more of a priority.” This resilience of ESG investing appears to be driven by the intertwining of ESG objectives with core financial performance considerations for fund managers.

The survey found that while ESG investment has already experienced impressive growth, it is set to accelerate sharply. Compared with our 2021 survey, investment fund companies are raising their projections of the likely future growth in ESG investing, predicting ESG investments to rise to 48% of portfolios 2-3 years from now, and to 57% in five years’ time. By the early part of the next decade, investment fund companies we surveyed expect ESG elements to be reflected in 64.2% of their asset management portfolios on average.

Fixed income leads asset class growth

In the 2021 Survey, fixed income was dramatically lagging equities, but investment managers have brought their use to be on par with the survey showing that it is emerging as the fastest growing ESG asset class. More than three quarters of companies (76%) now implement ESG criteria within fixed income compared to just 42% in 2021. This growing role of bonds in ESG investing is part of a more general broadening of ESG investing beyond its traditional home in equities. Commodities are also getting more attention from ESG investors, with 47% of fund-management companies we surveyed now implementing ESG criteria for this asset class, compared with 37% in 2021.

ESG…shorthand for carbon?

Although they show dramatic improvement in the quality of ESG data, the results also indicated that “E” is front stage, while “S” and “G” are backstage – at least for now. Environmental issues remain front and center for investment managers, with climate and carbon footprint issues dominating. This reflects in part the lack of quantifiable data and difficulties that investment fund companies face in evaluating the more diffuse and intangible aspects of social and governance performance by companies. Four out of five respondents overall agreed that “environmental criteria almost always tend to be prioritized over Social and Governance criteria”. While that may simply reflect the current realities of ESG investment, almost the same proportion (78%) agreed that “environmental criteria should always be given priority over social and governance criteria.” Notably, two thirds of respondents say that they “find it difficult to evaluate the social and governance performance of companies”

The conclusions drawn from this survey track closely with what we learned in last year’s 5th Annual Benchmark Survey, which found that the number of ESG indices increased by more that 43 percent in 2021, the largest single year-on-year increase for a single sector in the survey’s history. Investors and asset managers continue to have an strong appetite for ESG, pushing growth to new levels every year. It’s clear ESG investing is here to stay, and the IIA will be here to help guide the index industry through its continued evolution.

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

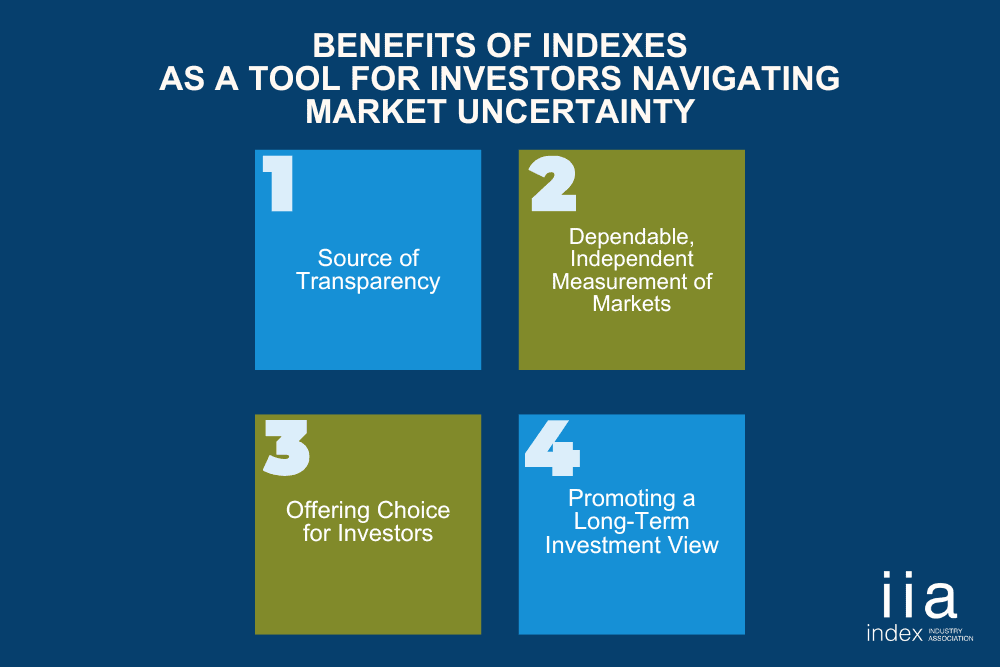

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…