The index industry has a long track record of evolving and expanding, with the goal of providing ever-increasing options for the public to track performance of various asset classes, investment styles, and strategies.

As the Index Industry Association celebrates the 10th Anniversary of our founding, we asked our member firms what they believe to be among the most significant developments in the index industry over the last decade.

Our member firms made a point to highlight how innovation within the industry and increased competition has given investors more options than ever before, allowing for them to invest in indexes that are specifically tailored to their needs.

“The industry’s greatest advancements of the past decade are the dramatic expansion and evolution of indexing capabilities and product design that has allowed what was initially a rather standardized product offering to become immeasurably tailorable to nearly any investor outlook, preference or objective, and to have been able to do so in a reliable, responsible and investible framework.

Whether the expansion of values-based indexing or the multidimensional capabilities of strategy-based indexing, the broad product complex is now well able to ensure a competitive and comprehensive marketplace for nearly any conceivable investor preference.”

- CRSP

“Substantial growth in indexation, which provides investors with more options. Indices give the market the freedom to pursue or outperform well-defined investment strategies.”

- FTSE Russell

“Over the past ten years, the index industry has advanced in ways that give investors greater choice and greater protection. It is estimated that there are now over three-million indices globally. Add to this the phenomenal rise of index-based passive investing, and it is clear today’s investor is the most empowered in history.”

- Cboe Global Markets

Another common theme throughout their responses was the substantial growth of the index industry, thanks in large part to innovation fueled by completion, globalization, and technology.

“Product innovation continues to broaden the scope of index investing. In the past decade, China’s capital market has never stopped innovating in index-linked products. These innovations have provided index investing with plenty of diversified investment tools and boosted the development of the domestic index industry in China.”

- China Securities Index (CSI)

“As technological innovations continue to stimulate new investment themes, the growth of products such as crypto and megatrend ETFs gather pace. Talking about transforming from traditional index business model, Data and Analytics is a growing space to meet customers’ sophisticated demands.”

- Hang Seng Index (HSI)

“Technology is a levelling mechanism – increasing the ability to bring in new competitors and entrants into the field while lowering cost, providing better pricing and less expensive information, bringing more value to the end investor.”

- Morningstar

“The speed of internationalization has accelerated. Indices have gradually become the driver for international capital flows, and index providers have laid out global index systems.”

- Shenzhen Securities Information Co. (SSIC)

IIA CEO Rick Redding concluded, “Investors have demanded more choices and innovation from the index industry over the past ten years and the industry has responded. As the pace of innovation continues to increase, we’ll continue to see further evolution in the industry to meet their demands.”

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

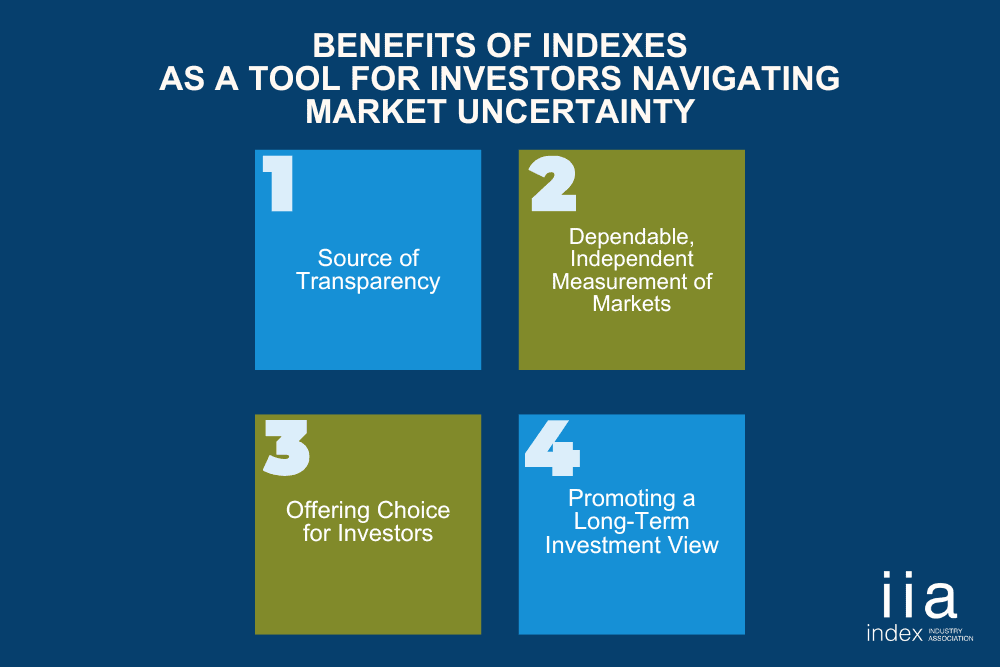

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…