The index industry has a long track record of evolving and expanding, with the goal of providing ever-increasing options for the public to track performance of various asset classes.

As the Index Industry Association celebrates the 10th Anniversary of our founding, we asked our member firms about the present state of the index industry and opportunities for further growth.

Our member firms highlighted the need to continue to innovate and introduce indexes to meeting the evolving needs of investors and track newer, emerging asset classes. Our members felt it was important to continue to explain the role and value of indexes in the broader market landscape and the opportunities that they can provide to investors who may be unfamiliar with them.

“We should work to raise the level of investor education around the role of market indexes and the benefits they can provide to investors. We will have the ability to have more precise investment exposures via indexes – the tools are getting more powerful but this only increases the need for investor education and guidance.”

- Morningstar

“The greatest potential lies in the untapped investing public, particularly in younger generations and emerging markets, many of whom have little or no investment exposure or experience, or rely on single-name assets of relatively brief and/or untested foundations, such as cryptocurrencies and meme-stocks. This presents a clear and exciting potential to further expand the marketplace.”

- CRSP

“We should be telling this story in a more accessible and human way, e.g. How indexing has helped transform and benefited markets and market participants over the years.”

- S&P

“The market demand for indices is becoming more customized, creating more opportunities for niche market index providers with increasingly diversified systems and compilations.”

- Shenzhen Securities Index Co. (SSIC)

“As wealth is transferred from older to younger generations, index providers can play an important role in helping investors achieve prosperity on their own terms. In particular, there is tremendous opportunity for index innovation in emerging new themes such as sustainability, ESG and digital assets. While these areas are still taking shape, it is clear they will play an important role for the indices of tomorrow.”

- Cboe

“Increasing global participation and buy-in for index-based investing across asset classes, including fixed income, crypto, commodities, etc.”

- Bloomberg

IIA CEO Rick Redding concluded, “The index industry is constantly evolving, and we are always looking for ways to meet the ever changing needs of investors. We remain focused on innovation, providing asset managers the ability to create new products that will help to reduce costs and provide access and exposure to markets that would otherwise be unavailable.”

We look forward to seeing how the index industry continues to work with the investment community to innovate and allow investors to benefit by the expansion into new markets. The IIA will be there to help with that growth every step of the way.

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

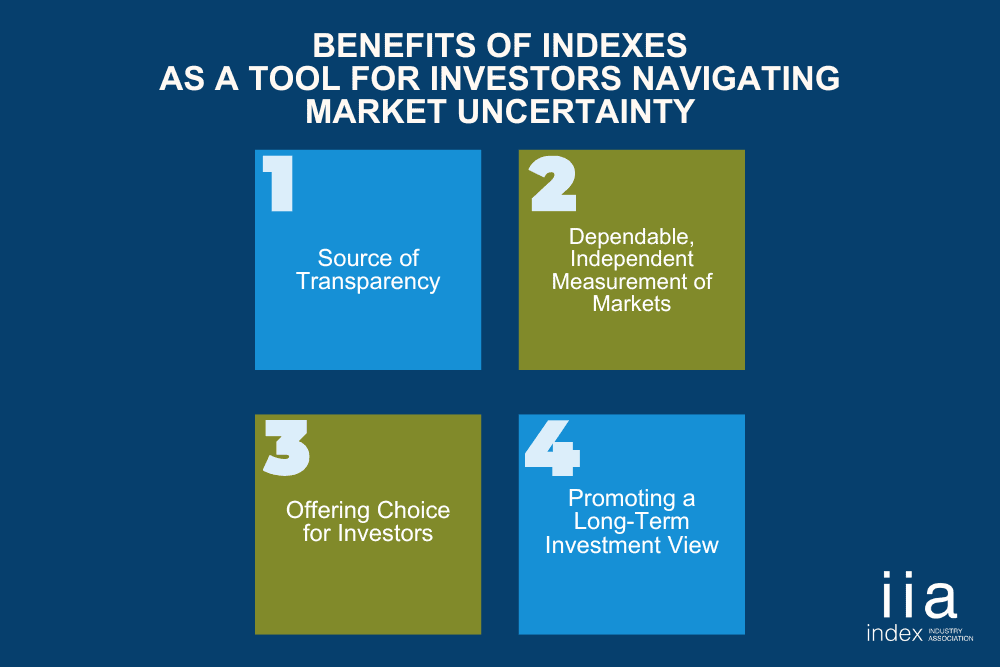

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…