As part of our ‘Voices of IIA’ series, we sat down with Rolf Agather, Global Head of Research and Product, Indexes at Morningstar.

As an index provider—as well as a source of investment research, management products, and services—Morningstar offers a unique perspective backed by extensive industry knowledge.

We discussed new trends and the evolution of the industry, as well as Morningstar’s role, and the different ways the company is leveraging its strengths to push the industry forward.

Tell us a bit about your current role at Morningstar and how it shapes your views of trends we are seeing in the index industry?

I’m an investment guy, so I generally look at things from an investment perspective. What’s remained constant about the index industry is that it’s the passive alternative to active investing. If you look at where the industry started, this notion of being a passive alternative is reflected in the use of the index as a benchmark. The index is still being used as a benchmark, but now, for an increasing community of investors, its primary use is to underlie an investment strategy. I think that’s been the largest shift.

What have your feelings been about that shift over time?

I think it promotes a more thoughtful approach to constructing indexes. Now, when we know the index is going to be used as the basis of an investment strategy, the industry has to think more seriously about issues such as tracking error and turnover. That change in role and function has raised the bar in terms of how we perceive the range of issues investors have to think about. The index industry now has a heightened level of awareness around certain investment considerations that it might not have had in the past.

How do you see Morningstar’s particular role as an index provider informing its place in the larger ecosystem?

We see ourselves as an investor advocate. When we think about designing indexes, we want to make sure that we’re thinking about the investor first. It’s important to recognize that the index plays a key role throughout the entire investment management process, whether it’s being used as a benchmark, as the basis of an investment strategy, or to analyze portfolios at the very end of the process. Transparency is something we highlight because, in order to be a fair benchmark, people need to understand what’s in it, how it’s constructed, and how it’s rebalanced. That’s one of the characteristics of an index-based investment strategy that distinguishes it from a more active strategy. You can see what’s in it. The investor can look at the holdings they’re getting, what’s being bought, what’s being sold, and the rules being used to create the portfolio. So that transparency permeates all the way through.

What do you see as the largest challenges ahead of the index industry? How are you approaching them?

I think one of the largest challenges facing the industry right now is the range and complexity of products. We all know that there are a lot of products coming on to the market. I’d like to think that the consumer will benefit from choice, but we also want to make sure that we’re providing enough information on our indexes for consumers to make educated choices.

On an individual level, I think one of the larger concerns facing the industry revolves around portfolio-customization. There are so many different factors one has to consider when building a portfolio; it can be overwhelming. I think there needs to be a better way to help individuals address and manage all of the important investment considerations involved in designing their investment strategy.

What areas do you see index providers showing leadership in? Are there any recent examples that stand out to you?

I’ve seen an increasing focus on investing that incorporates ESG measures. Whereas in the past, the goal of investing was rather one-dimensional – either to preserve or to grow wealth – today, there are additional responsibilities and layers of complexity. In terms of examples, we just saw an organization we work with, Engine No. 1, launch a new ETF and put more of an emphasis on active ownership. We’ve also been seeing firms who are both helping investors achieve investment goals as well as employing active ownership to achieve social and environmental goals.

What are some of the most exciting examples of this that you’ve seen?

Personally, I’m excited by market products that support the empowerment of women and minority groups, as well as those that support gender diversity. Last year, Morningstar launched a gender equality index, and I think the options that it provides are exciting. If you’re someone who’s passionate about social issues, there’s now a way for you to take a stand on those issues through investing. It’s great that these investment products can now provide you that opportunity to achieve goals in addition to those directly related to wealth management.

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

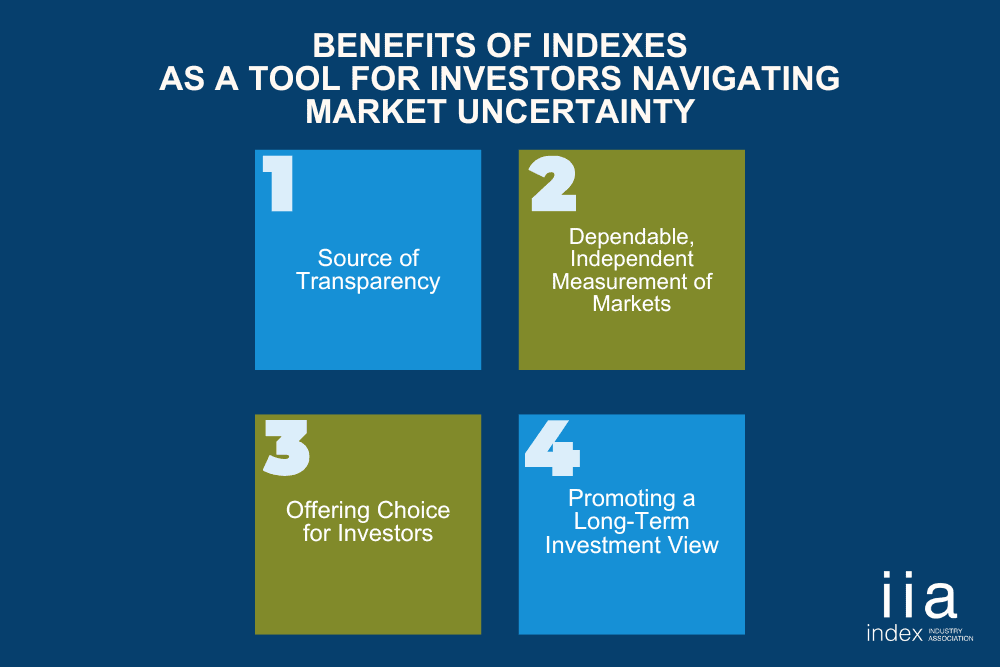

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…