The Index Industry Association sat down with Varun Pawar, ICE Fixed Income & Data Services Chief Product Officer and recently appointed IIA Board Member, to get his thoughts on his career journey, current role and opportunity for the global index industry.

Q: From Bangalore, India, to the UK, to the US. You’ve had quite a global background. Please share your career journey with us.

Yes, it has been quite a journey and a very data centric one from day one. I grew up in India and graduated from university with a degree in accounting and finance and at the time, around the early 2000’s, India was experiencing a massive outsourcing boom. Many people may not know that Bangalore is the Silicon Valley of India and was at the heart of the offshore data expertise boom. I was fortunate to be in the right place at the right time and was hired by Reuters (now LSEG after various mergers and acquisitions). Working for a multinational data company at such an early stage in my career gave me a strong global business and cultural foundation. At Reuters, my initial role was cleansing historical data which gave me very strong insights into the pain points of data collection and the importance of having precise data to make investment decisions.

Q: OK, that’s how you got started. How did you get to global indexes and the US?

I enjoyed my work at Reuters. It was something about taking a messy problem and straightening things out that really called out to me. At an early stage, I started building on that foundation and decided to pursue a Masters in Finance at Exeter University in the UK to broaden my knowledge of capital markets. Out of Exeter, I joined Bloomberg as a bond evaluator in 2007 covering investment grade debt for European corporates. In 2010, I relocated from the UK to New York and worked my way up through a series of roles to my last position as head of the Bloomberg Evaluated Pricing business in 2015.

In 2019, after 12 years at Bloomberg, I had the opportunity to join (former IIA Board member & NYSE Group President) Lynn Martin to take on a role at ICE Data Services and haven’t looked back. Under my current remit as Chief Product Officer, I oversee ICE’s data products ranging from entity data, corporate actions, reference data, evaluated pricing, indices and analytics.

Q: Tell me about your role at ICE Fixed Income & Data Services. Is it different running a fixed income shop?

If you mean, is it different from running an equity-based index shop, my answer is absolutely! ICE acquired the Bank of America Merrill Lynch family of indexes in 2017 and had to replace all reference data - the underlying constituent data - for the entire index family, which had been administered by Bank of America Merrill Lynch, with ICE’s reference data. One cannot underestimate the amount of complexity that goes into administering a global fixed income index franchise. First, you need accurate data for what can often be tens of thousands of bonds in one index, including accurate pricing data, and you need calculators that can work with this data to compute your yields, spreads and other analytics at a large scale. And, above all else, you need incredibly powerful technology to process hundreds of data fields to qualify bonds for various indices. You also need a very robust index methodology that governs ongoing index rebalancing and mimics some of the “real” world frictions asset managers face.

Q: What do you see as some of the unique challenges – and opportunities – for the index industry?

Don’t believe anyone who tells you that creating and maintaining an index is easy. It’s not. This is particularly true with fixed income, with its multiple fragmented data elements and very stringent quality checks. Index providers do incredible work and have very high standards in place to serve investors and we work through complex market and operational challenges all the time. Additionally, we are constantly trying to innovate and I think we need to recognize and celebrate that. We also need to recognize and embrace the incredible opportunity in front of us, particularly in the fixed income space where demand is growing rapidly for better fixed income indexes in today’s new global interest rate environment.

Q: What motivated you to raise your hand to recently join the IIA Board?

I was definitely encouraged by my organization to get more involved, but I am quite happy to do so. The IIA is a great sounding board for the index industry. I really enjoy the opportunity to work with my peers at other index providers to educate the market on our strengths and all the important checks and balances we have in place to make sure we do the right thing and best serve investors.

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

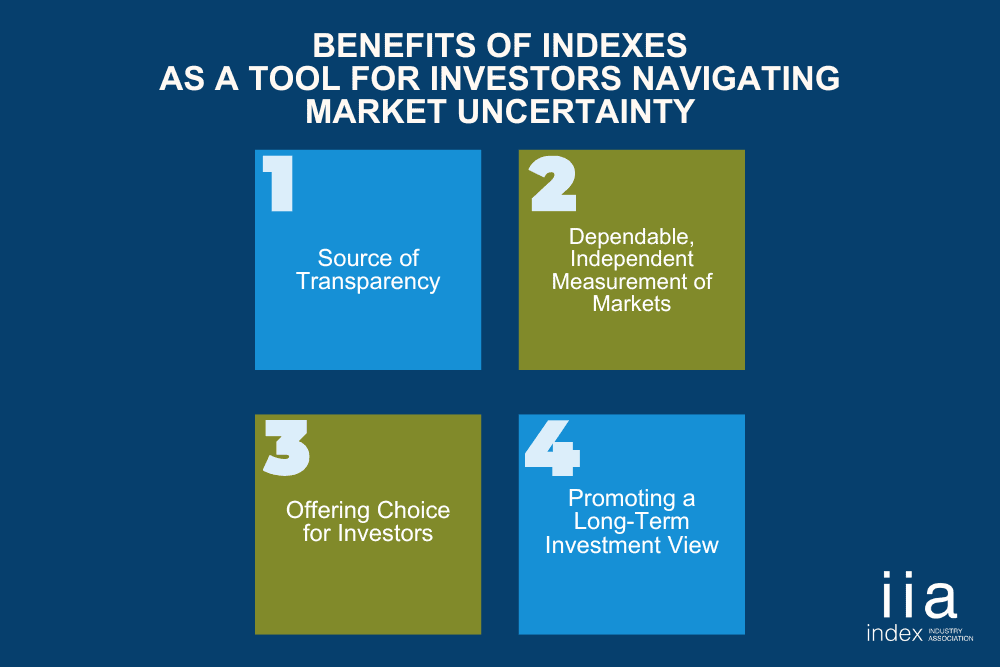

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…