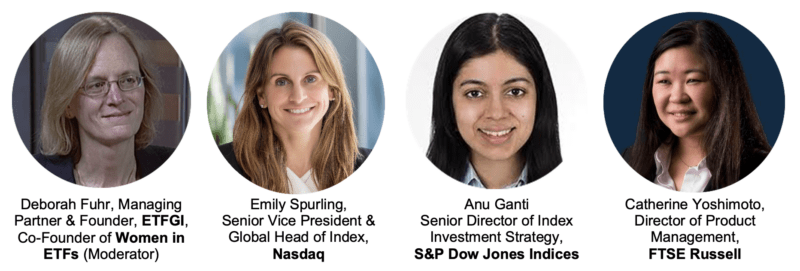

The IIA recently gathered leaders from global index providers to discuss progress the financial industry has made in creating and fostering opportunities for women. In the Voices of the Index Industry webinar, moderator Deborah Fuhr, ETFGI’s managing partner & founder and co-founder of Women in ETFs, acknowledged the industry’s diversity while hearing each panelist’s unique insight and perspective on where the index industry is headed.

While coming from varied backgrounds and contrasting career journeys, panelists echoed each other’s encouragement for women to participate in formal mentorship programs while balancing virtual and in-person networking to further their development. A recurring thread was to proactively seek out opportunities rather than waiting for a perfect fit, and each shared their take on maintaining a healthy work-life balance.

KEY TAKEAWAYS

Mentorships & Networking

Emily Spurling, Nasdaq: “Having mentors and sponsors is essential. I would encourage everyone to participate in formal programs whether through their companies or the industry as they allow you to make connections that you may otherwise not. I’d also encourage taking the unstructured approach to finding a mentor where you focus on individual outreach to find people that inspire you or hold roles you aspire to hold. Think of how you want to shape your future and how mentors and sponsors can help achieve your goals.”

Anu Ganti, S&P Dow Jones Indices: “Networking is critical and using the different formats available is key to stay connected in the industry. Pre-Covid we had a lot of in-person events that were disrupted into a virtual model. Attending a balance of both is beneficial because while virtual may be more accessible, live events still offer that personable interaction. There are numerous outlets to explore from company resources, school alumni programs and broader industry groups like Women in ETFs.”

Exploring Career Opportunities

Catherine Yoshimoto, FTSE Russell: “When considering new career opportunities, I may weigh whether the organization is still a fit or whether my role might be evolving in a direction I don’t agree with – both of which could be a catalyst for change. It’s important to feel a sense of accomplishment with your career where you feel you’re contributing something meaningful and helping achieve the organization’s goals while continuing your journey of personal development along the way.”

Emily Spurling, Nasdaq: “As women, when considering a new role, we tend to question whether we fit the entire checkbox perfectly or whether it’s the right time to make a change. Instead, I’d encourage women to focus on gaining a better understanding of what the role would entail, deciphering what the company is seeking for it and whether it aligns with what you’re trying to get out of the role personally. Don’t get hung up on worrying whether the timing is right or if you’re a perfect match. If you’re 75% of the way prepared, you can figure out the remaining 25% when you’re in the new role.”

Innovation in the Index Industry & Areas Poised for Growth

Catherine Yoshimoto, FTSE Russell: “The benefit of the index industry to the financial ecosystem is bringing transparency to areas that haven’t been as transparent in the past. Where there have not been widespread established standards, that’s likely where the next evolution is headed. For example, the expansion into digital assets isn’t as transparent so it’s an area of interest and potential growth. Looking at the differences in regional priorities, ESG is a huge focus in Europe but is another area where there aren’t established industry-wide standards, so there’s potential to identify ways to better benchmark this area.”

Emily Spurling, Nasdaq: “We’re seeing flows going into fixed income as well as income-based and defined outcome products. On the global side, different regions have different demands. In APAC, we’re seeing demand for our core products as well as thematic tech and more innovative products. In EMEA, it’s all about ESG. We are focused on helping clients navigate the regulatory and industry framework with solutions that allow them to meet their obligations and their ESG objectives. We’re doing a lot of work around aligning to those regulatory and industry frameworks as well as identifying solutions within the ESG space that incorporate inclusionary tactics as well or rather areas focused on themes within ESG. As companies continue focusing on ESG, we anticipate seeing more opportunities in rules-based, data-driven approaches to take ESG investing “beyond beta.”

Maintaining a Work-Life Balance

Anu Ganti, S&P Dow Jones Indices: “Covid taught us a lot about staying connected with friends and family and maintaining that balance as we transition into the hybrid work environment is key. If you’re balanced both mentally and physically, you’re going to be a happier, more holistic person at work and channel that into your ideas.”

Emily Spurling, Nasdaq: “Set your boundaries, let other people know them and make sure you stick to them. Another great thing to keep in mind is that ‘no’ is a decision and ‘yes’ is a responsibility. So, make sure to say no when needed because the more yes’s you give out, the more responsibilities you take on, which might not be your priority.”

Continued Room for Improvement

Anu Ganti, S&P Dow Jones Indices: “The resources we have at our disposal at our companies is a big factor. Seeing examples of senior women leaders talking about their career journeys and offering advice to the next generation has been very helpful. The mentorship programs are a two-way street where you’re not just learning as a mentee but you’re also learning being a mentor.”

Catherine Yoshimoto, FTSE Russell: “Studies have shown that diversity leads to better outcomes. It’s not one or the other, rather it has to be different views working together to create better outcomes. Businesses set targets for women leadership so it’s important that we ask for these targets and hold individuals accountable. Let’s make sure different views are represented so that we are coming to a better overall outcome.”

These are the panelists’ own observations and do not reflect the formal viewpoints of their companies. To view the full webinar, visit the IIA’s Vimeo page.

You might also be interested in

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

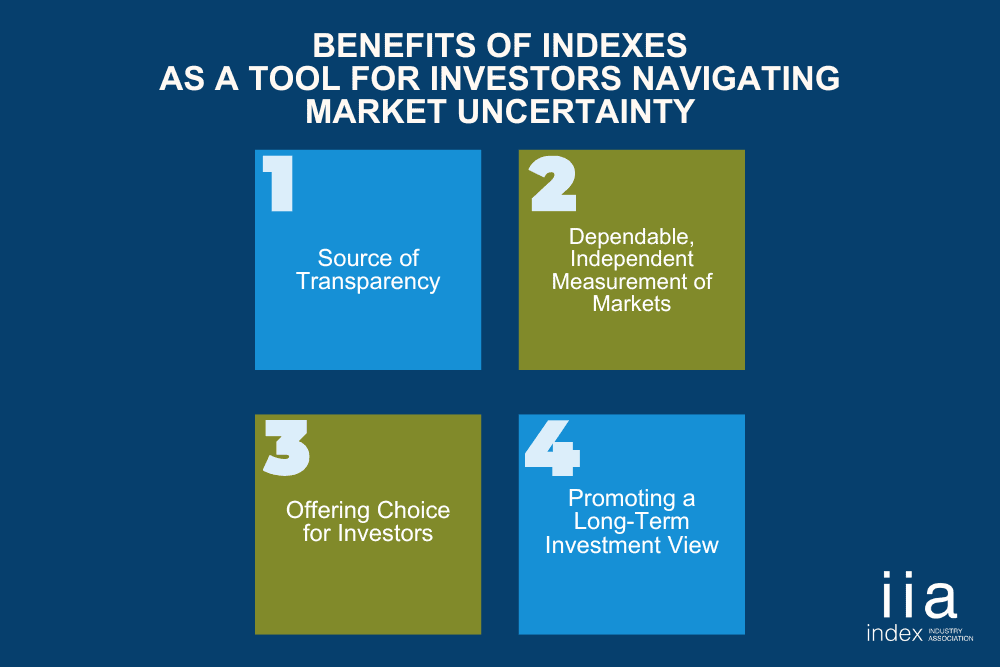

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…