Featured Insights

Index Minutes: Sustainability Indexes

In our latest installment of our Index Minutes series, STOXX Index Product Management Saumya Mehrotra explains what…

All Insights

Index Minutes: Sustainability Indexes

In our latest installment of our Index Minutes series, STOXX Index Product Management Saumya Mehrotra explains what…

IIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council…

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

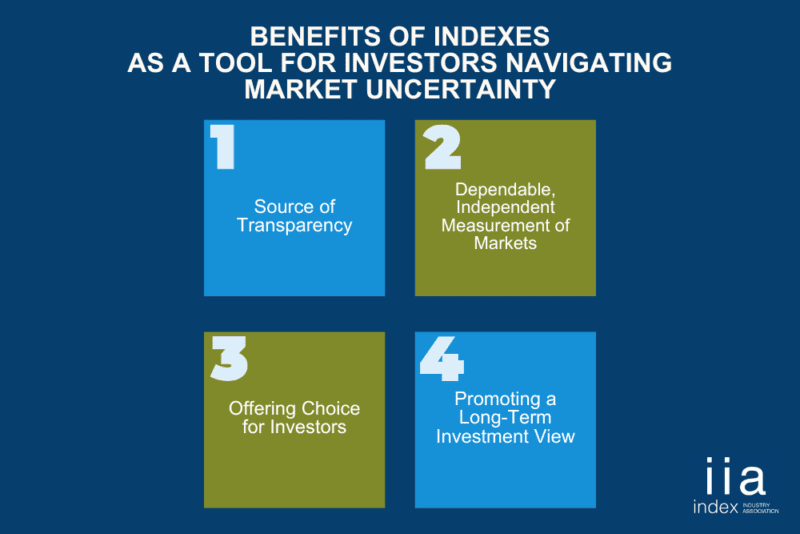

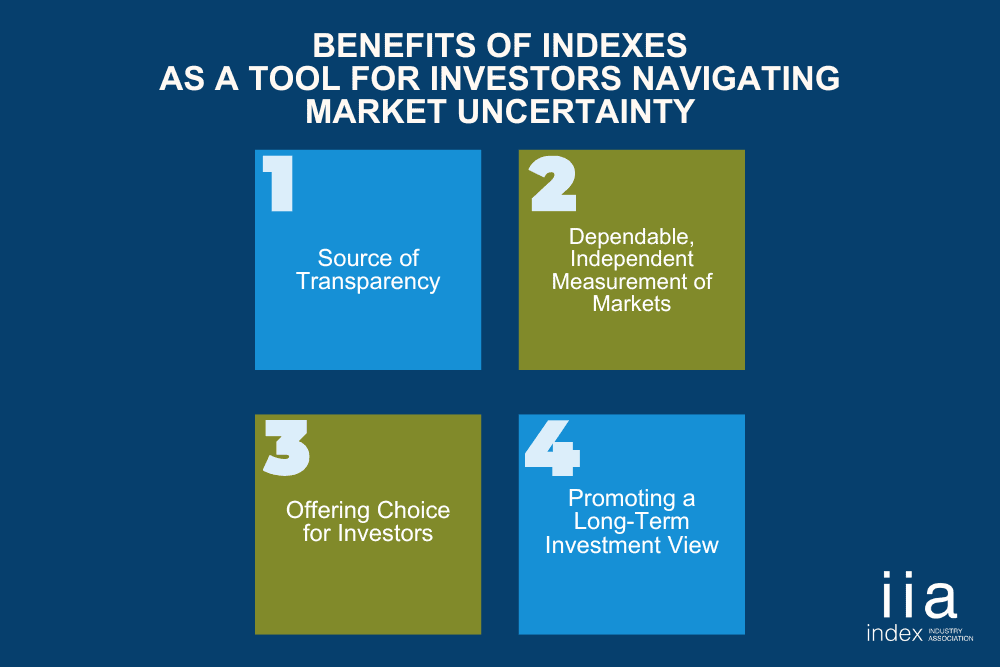

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…

The Future is Bright for the Index Industry

A Message from Retiring CEO Rick Redding It has been an incredible honor to lead the Index…

The nature and role of financial benchmarks in supporting vibrant capital markets

What is a financial index? What is their role in the financial value chain? How can indexes…

Voices of the IIA – Varun Pawar, ICE

Articles, Member Insight May 28, 2024 The Index Industry Association sat down with Varun Pawar, ICE Fixed…

Voices of the IIA – Suzanne Ropeta, Morningstar

May 6, 2024 The Index Industry Association recently caught up with Suzanne Ropeta, Head of Global Marketing…

Member Insight: “Indices and Benchmarks Made Clear” – FTSE Russell

Investors who hear the word “benchmark” often use it interchangeably with the word “index.” But there are…

Member Insight: “Remember the Retail Investor!” – Morningstar

Morningstar Chief Indexing Officer Gareth Parker writes about the importance of educating retail investors on the benefits…