Index Minutes: Sustainability Indexes

In our latest installment of our Index Minutes series, STOXX Index Product Management Saumya Mehrotra explains what sustainability indexes are, provides examples of what they’re used for and how they can help investors, and discusses the benefits index providers bring to the sustainable investing process.

Read MoreIIA Response to Final Approval of EU Benchmark Regulation Review

Today, the European Parliament adopted the final text of the Benchmarks Regulation (BMR) in its Plenary session. the Council had approved the text on 12 March. The provisions will start to apply on 1 January 2026. On the record statement from IIA CEO Kirsten Wegner: The final approval of the Benchmark Regulation in the European Parliament marks an important…

Read MoreMember Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely used in U.S. wealth management, yet they remain underutilized. Together with Cerulli Associates, S&P Dow Jones Indices published a research study on the use of index-based products and solutions within the U.S. wealth management market. The research aims…

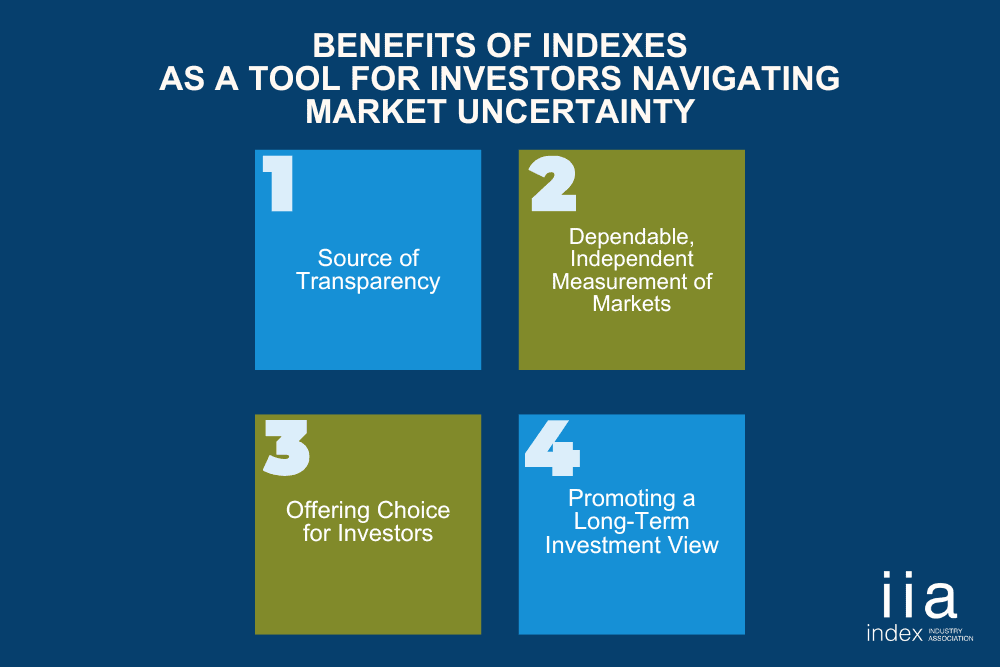

Read MoreMarket Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession fears, it is more vital than ever that market participants have confidence that the markets are functioning as intended, and are knowledgeable of tools available for informed decision-making. IIA CEO Kirsten Wegner’s insight on how indexes and…

Read MoreIIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I had the privilege of joining the World Federation of Exchanges’ CEO Nandini Sukumar to share observations on technology and other shifts influencing investment and trading today. A few of our main takeaways included: Markets Functioning as Intended, Despite…

Read MoreThe Future is Bright for the Index Industry

A Message from Retiring CEO Rick Redding It has been an incredible honor to lead the Index Industry Association (IIA) over the last 12+ years and with a heavy heart that I announce my retirement as CEO. Knowing this milestone was approaching, I have found myself reflecting on the remarkable journey we’ve traveled since the…

Read MoreThe nature and role of financial benchmarks in supporting vibrant capital markets

What is a financial index? What is their role in the financial value chain? How can indexes be part of the solution to restore Europe’s competitiveness? Index providers have a unique role to play. From increasing transparency and reducing cost to empowering retail and professional investors, indexes help develop Europe’s Capital Markets Union. Learn more…

Read MoreIndex Minutes: Methodology

Voices of the IIA – Varun Pawar, ICE

Articles, Member Insight Voices of the IIA – Varun Pawar, ICE May 28, 2024 The Index Industry Association sat down with Varun Pawar, ICE Fixed Income & Data Services Chief Product Officer and recently appointed IIA Board Member, to get his thoughts on his career journey, current role and opportunity for the global index industry….

Read MoreVoices of the IIA – Suzanne Ropeta, Morningstar

Articles, Member Insight Voices of the IIA – Suzanne Ropeta, Morningstar May 6, 2024 The Index Industry Association recently caught up with Suzanne Ropeta, Head of Global Marketing for Morningstar Indexes and Morningstar Sustainalytics to learn more about her background, current role and opportunities ahead for Morningstar. Q: Tell us about your background in…

Read MoreMember Insight: “Indices and Benchmarks Made Clear” – FTSE Russell

Investors who hear the word “benchmark” often use it interchangeably with the word “index.” But there are differences between the terms, and Index Industry Association member FTSE Russell aims to clear up misconceptions with its report, “Indices and Benchmarks Made Clear”, authored by David Sol, FTSE Russell Managing Director and Global Head of Policy and Governance. …

Read MoreMember Insight: “Remember the Retail Investor!” – Morningstar

Morningstar Chief Indexing Officer Gareth Parker writes about the importance of educating retail investors on the benefits of index-based investing, noting that the topic “isn’t understood” among even the most savvy retail investors. In the article, Parker gives a “rundown of the benefits of indexing” noting that it is a “strategy that combines market returns,…

Read MoreIndex Minutes: Regulations Review, Part Two

In part two of his review of index industry regulations, Bloomberg Global Head of Index Governance Vinay Reddy reviews why safeguards are important for investors and the industry at large.

Read MoreIndex Minutes: Regulations Review, Part One

Bloomberg Global Head of Index Governance Vinay Reddy reviews how the global index industry is regulated including a review of oversight functions, good governance, and EU and UK rules.

Read MoreIndex Minutes: Evolution of the Index Industry

S&P Dow Jones Head of U.S. Index Investment Strategy Anu Ganti reviews the evolution of the index industry and gives statistics on the rise of passive investing.

Read MoreIndex Minutes: Inside a Financial Index

FTSE Russell Director of Product Management Catherine Yoshimoto reviews the basics of a financial index, including methodology, weighting, and the relationship between index providers and asset managers.

Read MoreInnovation, Opportunity Define the Future of the Indexing Industry

Articles Innovation, Opportunity Define the Future of the Indexing Industry March 18, 2024 Perspective from Fiona Bassett, IIA Chair and FTSE Russell CEO Cutting edge technology, artificial intelligence, data science, huge structural tailwinds, disruption, enormous growth potential – are we describing an emerging new tech sector? In fact, we are describing the world of indexing…

Read MoreWomen Leaders in the Index Industry: A Panel Discussion

Member Insight: “Ingredients of Index Construction”- Nasdaq

Articles, Member Insight Member Insight: “Ingredients of Index Construction”- Nasdaq February 13, 2024 A Market Makers article from IIA member Nasdaq reviews the basic “ingredients” that are needed to create a financial index. The article, “Ingredients for Index Construction,” was written by Nasdaq Chief Economist Phil Mackintosh and Nasdaq Head of Americas Index Product Development…

Read MoreIIA Updated Comments on EU Benchmark Regulation (BMR) Review

The IIA released updated comments on the EU BMR, following a draft report by Rapporteur Fernandez. The IIA welcomes the draft report by Rapporteur Fernandez and appreciates that in the report the rapporteur agrees with the main objectives of the revision as proposed by the European Commission and as predominantly also agreed to by the…

Read MoreIndex Industry Association Concerns with the European Parliament’s Retail Investment Strategy Draft Report

The Index Industry Association (IIA) supports the objective of encouraging retail investment and believes this will bring significant benefits to both retail investors and the European capital markets. To this end, we welcome the adoption of a Retail Investment Strategy that allows European retail investors to benefit from lower costs and better access to investment…

Read MoreIIA Position on EU Benchmark Regulation Review

The Index Industry Association (IIA) welcomes the European Commission initiative to reduce reporting requirements by 25%, in line with the objective to boost the EU’s long-term competitiveness. The Proposal to review the Benchmark Regulation’s (BMR) scope and third- country regime is a concrete and welcomed measure to achieve this objective. The IIA supports the BMR’s…

Read MoreIIA Open Letter to Japanese FSA on Tsumitate NISA

The IIA submitted an open letter to the Japanese Financial Services Agency (FSA) requesting an expansion of the list of indices designated for the new Tsumitate Nippon Individual Small Account (NISA) system. The Tsumitate NISA was originally launched in 2018 to encourage the younger generation, novice to investing in stocks, to develop supplementary retirement savings,…

Read MoreWhat is a Financial Index?

Videos What is a Financial Index? November 13, 2023 If you follow markets, you’ve heard about indexes. But do you know exactly what an index does and why you can’t invest in one itself? This video provides an overview of the financial index and describes the critical products and services indexes provide to global investors….

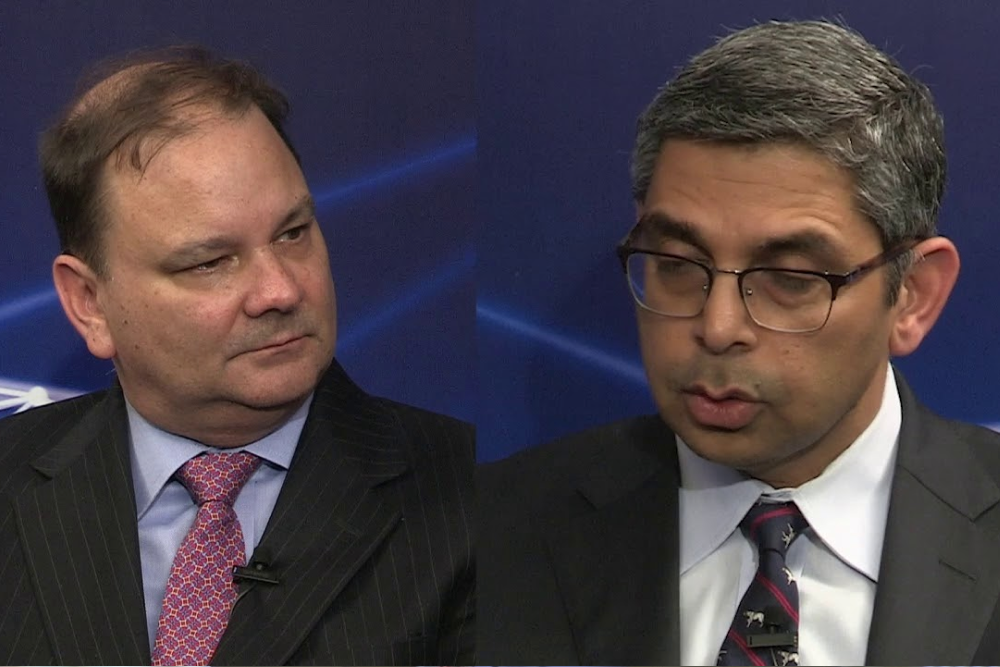

Read MoreHow Asset Managers Are Evolving on ESG: A Conversation with Rick Redding and Mark Purdy

How Asset Managers Are Evolving on ESG: A Conversation with Rick Redding and Mark Purdy September 22, 2023 IIA CEO Rick Redding speaks with one of the author’s of the 2023 IIA ESG Survey, Mark Purdy, managing director of Purdy Associates. In this conversation, they discuss some of the surprising findings this year. They also…

Read MoreVoices of the IIA – Tom Kuh, Morningstar Indexes Head of ESG Strategy

Voices of the IIA – Tom Kuh, Morningstar Indexes Head of ESG Strategy September 20, 2023 Tom Kuh, Morningstar Indexes Head of ESG Strategy The IIA sat down with Thomas Kuh, Head of ESG Strategy for Morningstar Indexes, to talk about his role at Morningstar, perspectives gathered from his more than 30 years in ESG…

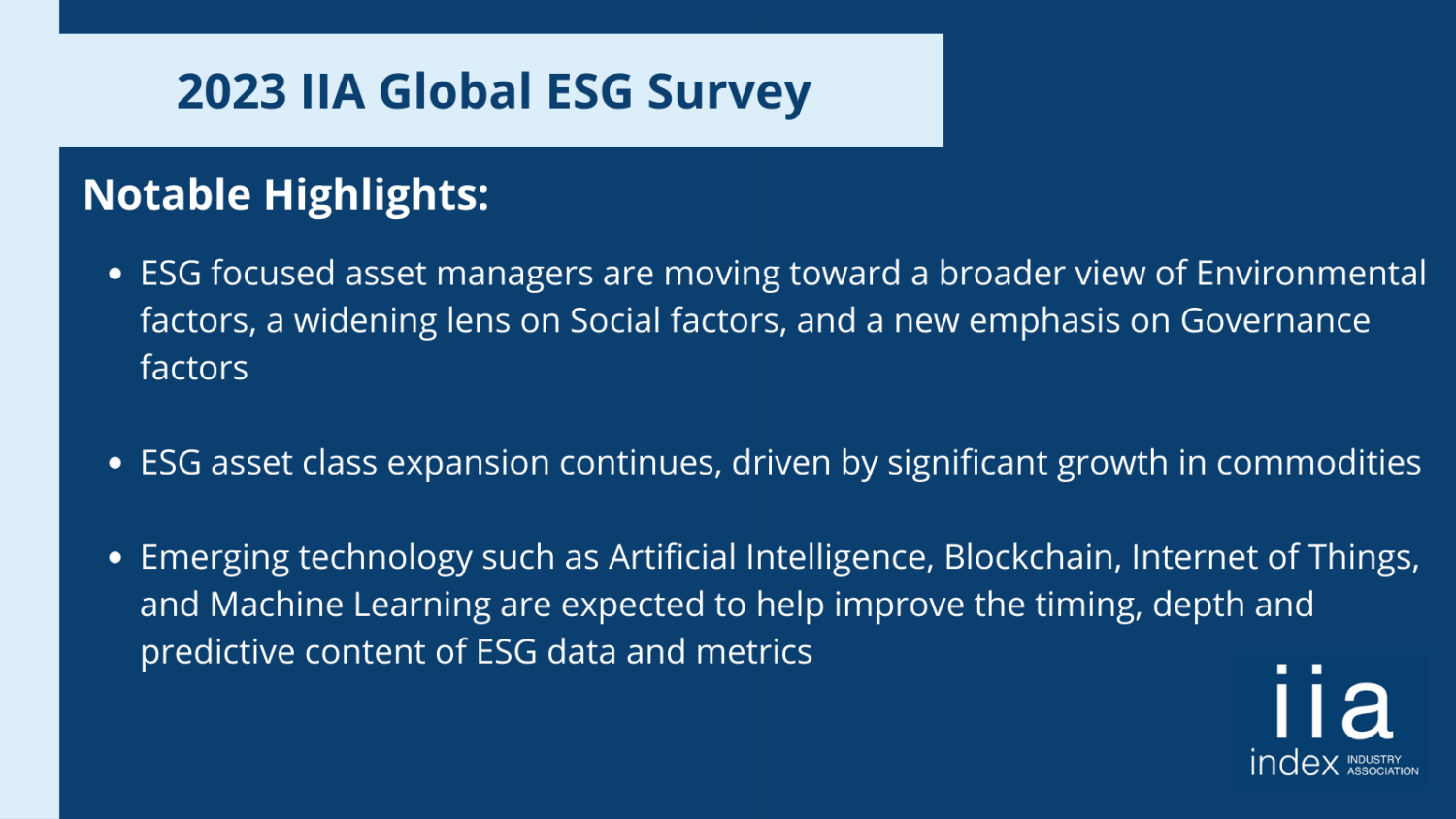

Read MoreIndex Industry Association’s Third Annual Global ESG Asset Manager Survey

Index Industry Association’s Fourth Annual Survey of Global Asset Managers Entering 2024, change was afoot in the asset management industry driven by an anticipated volatile economic environment, an election super cycle, political polarization around ESG investing and unbridled hype around AI. At the mid-point of the year, a clearer picture began to emerge of how…

Read MoreIIA Response to the European Commission’s Call for Evidence on the Review of the Scope and Third-Country Regime of the EU Benchmark Regulation

The Index Industry Association (IIA) has submitted a response to the European Commission’s Call for Evidence on the review of the scope and third-country regime of the EU Benchmark Regulation. In the response, the IIA reaffirmed its position that all benchmarks do not present the same levels of systemic risk, and that the Benchmark Regulation’s…

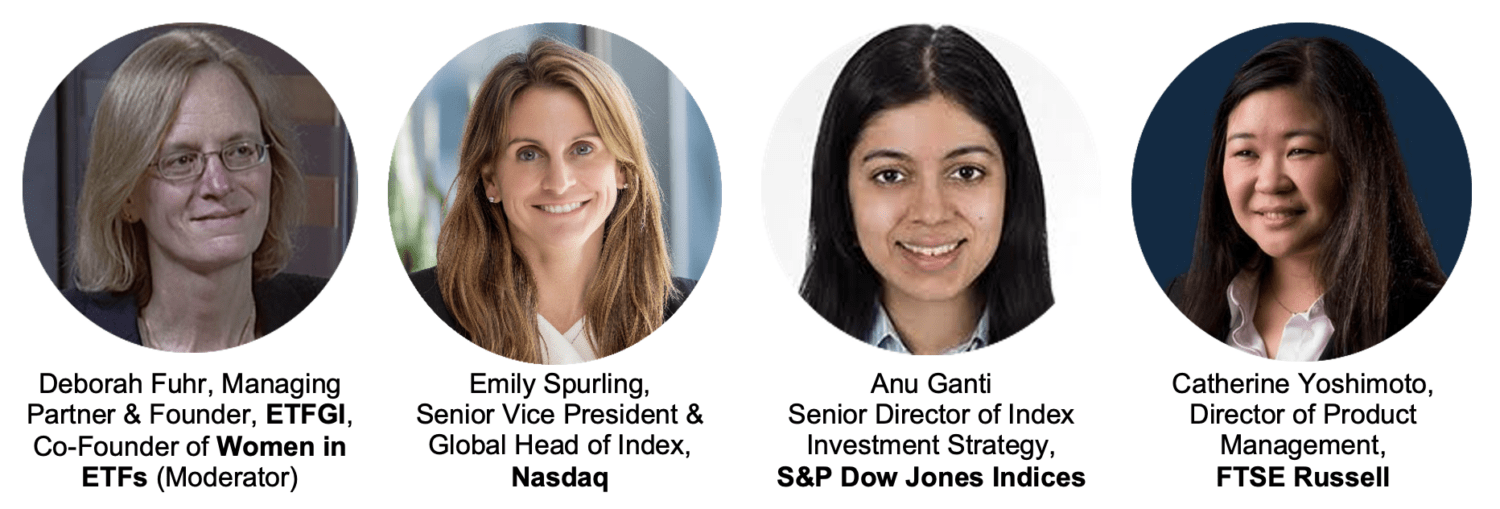

Read MoreWomen’s History Month Panel Reflects on Index Industry Embracing Diversity

The IIA recently gathered leaders from global index providers to discuss progress the financial industry has made in creating and fostering opportunities for women. In the Voices of the Index Industry webinar, moderator Deborah Fuhr, ETFGI’s managing partner & founder and co-founder of Women in ETFs, acknowledged the industry’s diversity while hearing each panelist’s unique…

Read MoreVoices of the IIA – Lauren Young, Cboe Global Markets

The IIA sat down with Cboe Senior Director of Index Governance Lauren Young to talk about, among other topics, her role at Cboe, what she’s most excited about and how she defines leadership. Q: What do you enjoy most about your role at Cboe? One thing I greatly enjoy about my role within Cboe Global…

Read MoreVoices of the IIA – Molly McGregor, Qontigo

As head of global marketing and communications for Qontigo, Molly is responsible for global brand and market positioning, product marketing and go-to-market campaigns, corporate communications, media and advertising, global conferences and events. She recently offered her perspective on what is most challenging and rewarding about her role, inclusive leadership and engaging clients in a post-pandemic…

Read MoreVoices of the IIA – Amelia Furr, Morningstar Indexes

The IIA sat down with Amelia Furr, Global Head of Sales for Morningstar Indexes, to talk about her role at Morningstar, her thoughts on inclusive leadership and the role of women in the index industry, what she is most excited about for the index industry and how she defines leadership. Q: What is the most…

Read MoreESG Fixed-Income Exposure: Index Providers Respond to Asset Manager Demand

By Rick Redding, CFA Originally published November 30, 2022 in the CFA Institute’s “Enterprising Investor” What does the latest Index Industry Association (IIA) global membership survey reveal about current trends in indexes and benchmarks? Chief among the key data points is that the rapid expansion of environmental, social, and governance (ESG) indexes continues to gain momentum and diversify…

Read MoreESG Criteria: Global Asset Managers Expand Their Embrace

By Rick Redding, CFA Originally published September 7, 2022 in the CFA Institute’s “Enterprising Investor” The number of environmental, social, and governance (ESG) benchmarks and indexes demanded by the asset management community has grown at an unprecedented rate over the past two years. That’s according to our latest survey of Index Industry Association (IIA) members. Unpacking these…

Read MoreInsights from the IIA’s Second Annual Global ESG Asset Manager Survey

The IIA released our Second Annual Global ESG Survey of Asset Managers. This year’s survey examined the evolving role of ESG investment in the asset management industry and the growth it experienced in the face of geopolitical instability, a 40 year high in inflation and six months of market volatility. We once again, partnered with…

Read MoreIIA Member Firms Reflect on the Impact of the IIA (Part 2)

Since its founding, the IIA has represented the global index industry in regulatory matters. We work closely with market participants, regulators, and other representative bodies to promote sound practices in the industry that strengthen markets and serve the needs of investors. As the Index Industry Association celebrates the 10th Anniversary of our founding, we took…

Read MoreIIA Response to SEC Comment Request re: Information Providers Acting as Investment Advisors

The Index Industry Association (IIA) submitted a response to the U.S. Securities and Exchange Commission’s (Commission) request for comment on “Certain Information Providers Acting as Investment Advisers” (Comment Request). In the response, the IIA noted that it does not agree with the Commission’s suggestion to regulate index providers as investment advisers under the Advisers Act…

Read MoreThe Present State of The Index Industry and Opportunities for Growth

IIA Comments on Third-Country Regime under BMR

Last week, the IIA responded to the European Commission’s consultation on the functioning of the third-country regime under the Benchmark Regulation (BMR). The consultation is meant to seek views on whether the current provision of third-country benchmarks to EU end-users is functioning properly, and to collect data to demonstrate whether the current framework should be amended….

Read MoreIIA Member Firms Highlight the Industry’s Continued Innovation

The index industry has a long track record of evolving and expanding, with the goal of providing ever-increasing options for the public to track performance of various asset classes. As the Index Industry Association celebrates the 10th Anniversary of our founding, we asked our member firms about the present state of the index industry and…

Read MoreIIA Member Firms Reflect on the Impact of the IIA (Part 1)

As the Index Industry Association celebrates the 10th Anniversary of our founding, we took the opportunity to ask our member firms about the impact the IIA has had on the industry and key stakeholders. In the post below, our member firms to share their thoughts on the role of the IIA, and the initiatives they…

Read MoreIIA Member Firms Highlight the Growth and Innovation of the Index Industry

The index industry has a long track record of evolving and expanding, with the goal of providing ever-increasing options for the public to track performance of various asset classes, investment styles, and strategies. As the Index Industry Association celebrates the 10th Anniversary of our founding, we asked our member firms what they believe to be…

Read MoreHighlights of Index History Timeline

For more than 125 years, IIA members have been administering indices and providing benchmarks. During that time the industry has grown from measuring a few markets to where we stand today – meeting investor demand for benchmarks globally. As the index industry has continued to grow and evolve, it has remained focused on its core…

Read MoreIIA Member Firms Highlight the Rise of ESG Indexes

The index industry has a long track record of continuing to evolve and innovate, with the goal of providing ever-increasing options for the public. When we asked our member firms about the present state of the industry and the biggest opportunities on the horizon, we noticed that one theme that continuously popped up – ESG….

Read MoreEU Regulations

The Benchmarks Regulation introduces a regime for benchmark administrators that ensures the accuracy and integrity of benchmarks. ESMA developed draft regulatory technical standards (RTS) and implementing technical standards (ITS) on a large number of areas, and also provided the Commission with Technical Advice. ESMA coordinates the supervision of benchmark administrators by national competent authorities. For…

Read MoreIOSCO Principles

The IOSCO (International Organization of Securities Commissioners) Task Force on Financial Market Benchmarks Consultation Report is an important milestone in the global response to recent investigations and enforcement actions against attempted manipulation of certain benchmarks. IIA shares the Task Force’s commitment to the development of benchmarks with high levels of transparency and integrity. Click to…

Read MoreSEC Comment on Tailored Reports

The Index Industry Association (IIA), an independent, not-for-profit organization composed of leading global independent index administrators, has commented on the Securities and Exchange Commission’s (SEC) proposed rule regarding Tailored Shareholder Reports. In the response, the full text of which can be found here, the IIA supports the SEC Proposed Rule which requires funds to disclose…

Read MoreIndexes 101

What is an index? • A financial index measures the performance of a list of instruments (bonds, stocks, etc.) that are selected and weighted according to an employed methodology that describes a set of rules governing the construction of the index. • IIA defines an index “as a number calculated by reference to a theoretical…

Read MoreIndex Industry Association Celebrates 10th Anniversary With NYSE Bell Ringing

The Index Industry Association (IIA) marked the 10th Anniversary of its founding with a closing bell ceremony at the New York Stock Exchange (NYSE). I was joined to commemorate this important occasion by NYSE President Lynn Martin, a former IIA Board Member, IIA Chair Dan Draper of S&P Global and representatives from our member firms…

Read MoreDan Draper, Chairman of IIA, on Transparency, Independence, and Integrity as the Bedrocks of Indexing

As he assumes the chair of the Index Industry Association, Dan Draper, CEO of S&P Dow Jones Indices, reflects on the evolution and impact of indexing on financial markets. He writes about the development of indices more than 100 years ago and the IIA’s role in strengthening and protecting the independence and integrity of these…

Read MoreCboe Global Markets’ Catherine Clay on Philosophy, Leadership, and the Future of the Index Industry

As part of our ‘Voices of IIA’ series, we sat down with Catherine Clay, Executive Vice President, Global Head of Data and Access Solutions at Cboe Global Markets From floor trader to Executive Vice President, Cathy Clay’s 360° view of the exchange industry is helping Cboe Global Markets define the future. Cathy helms the newly created Data and Access Solutions division (DnA) that aims to simplify global market complexities through innovative data, analytics and index offerings. What does Cboe’s approach to indexing tell…

Read MoreTrends and Evolution of the Index Industry with Morningstar’s Rolf Agather

As part of our ‘Voices of IIA’ series, we sat down with Rolf Agather, Global Head of Research and Product, Indexes at Morningstar. As an index provider—as well as a source of investment research, management products, and services—Morningstar offers a unique perspective backed by extensive industry knowledge. We discussed new trends and the evolution of the industry, as well as Morningstar’s role, and…

Read More5th Annual Benchmark Survey – Record Growth in Number of ESG Indices, Alongside Broadening of Fixed Income Indices

Index Industry Association’s Fifth Annual Benchmark Survey Shows Record Growth in Number of ESG Indices, Alongside Broadening of Fixed Income Indices

Read MoreNasdaq’s Sean Wasserman on the Evolution of the Index Industry

As part of our ‘Voices of IIA’ series, we sat down with Sean Wasserman, Vice President and Global Head of Index & Advisor Solutions at Nasdaq. As an index provider as well as a trading and listing venue, Nasdaq sees the indexing industry from a variety of viewpoints. We discussed how Nasdaq sees its role…

Read MoreEverybody was Da-ta Mining

This podcast takes a deeper look at why asset managers are clamoring for better data and standards to meet rising demand for ESG strategies.

Read MoreIndex Industry Association ESG Survey

Articles Index Industry Association ESG Survey July 21, 2021 With global demand for Environmental, Social and Governance (ESG) investment strategies continuing to increase, the Index Industry Association (IIA) sponsored a survey of a cross-section of U.S. and European asset managers to find where opportunities and challenges exist and how index providers play an essential role….

Read MoreThe IIA 2020 Index Foundations Video Series

Part I: What is an Index? Part II: The Index Fund Value Chain Part III: Why Indexes are Important Part IV: A Deep Dive Into Benchmarks and Products Part V: Fixed Income Indexes

Read MoreThe IIA 2020 Index Foundations Video Series

Part I: What is an Index? Part II: The Index Fund Value Chain Part III: Why Indexes are Important Part IV: A Deep Dive Into Benchmarks and Products Part V: Fixed Income Indexes

Read MoreLet’s Talk ETFs: Not All Indexes Are Passive – And That’s A Good Thing

IIA CEO Rick Redding joins the podcast to clear up misconceptions about the index industry.

Read MoreThe Money Life Show with Chuck Jaffe

IIA CEO Rick Redding joins the podcast.

Read MoreMarket Structure & Corporate Governance

Is passive investing the next bubble? The impact of passive investing on price discovery Companies not issuing voting shares Has indexing become too big for the market?

Read MoreESG & Issues in Fixed Income

Why is ESG the fastest growing area of indexing? Opportunities and challenges in the next 5 years What is driving growth in fixed income?

Read MoreFinancial Market Indices: Facilitating Innovation, Monitoring Markets

By Andrew Clare & Steve Thomas, Cass Business School, City University London While the advent of the modern stock market index is usually traced to the creation of the Dow Jones Industrial Average in 1896, it was the pioneering asset pricing work some 60 years later of Harry Markowitz1 who introduced Modern Portfolio Theory in…

Read MoreThe Financial Index Industry

By The Committee for Economic Development (CED) Financial indices are designed to provide investors with a way to reduce the complexity and increase the comprehensibility of financial markets – and yet, indices themselves are largely misunderstood. Indices are also commonly confused or conflated with index funds. Somewhat ironically, indices enable an abbreviated lexicon that is…

Read MoreSmart Beta Has Crossed The Rubicon

By Rolf Agather, Managing Director of Research, North America, FTSE Russell The findings of our latest annual global survey of smart beta usage by asset owners (with a collective AUM of over $5 trillion), suggests that smart beta is now a standard tool in investors’ armories. For the first time, we found that the majority…

Read MoreThe Money Life Show with Chuck Jaffe

IIA Senior Leader Series

The impact of regulation on the industry The growth of rules-based passive products The rise of smart beta and ESG

Read MoreBenefits of Independent Index Providers

How do investors benefit from independent indexes? The importance of transparency, efficiency and technology How an independent administrator fits into the ecosystem Index maintenance and avoiding conflicts of interest

Read MoreImportance of Methodology

Providing transparent and accurate information Why investors should care about methodology Methodology of rule-based products Methodologies of smart beta indexes Index calculation, maintenance and rebalancing Companies going public with restricted voting shares

Read MoreSmart Beta & Factors

Discovering opportunities in smart beta. How do you define smart beta? How should investors look at smart beta? Methodology of smart beta indexes

Read MoreIndex Industry Association Surveys the Index Universe

Index Industry Association (IIA), a global organization of index administrators, today announced the results of a revealing new survey of its fourteen member firms that quantifies the total number of indexes available globally for the first time ever. According to the survey, there are 3.288 million indexes globally with equity indexes representing over 95 percent…

Read More